sales tax in orange county california 2021

Box 1438 Santa Ana CA 92702-1438. Method to calculate Orange County sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax.

Sales Tax In Orange County Enjoy Oc

Ad Find Out Sales Tax Rates For Free.

. Here is the breakdown of the of 725 minimum CA sales tax. 82 rows The total sales tax rate in any given location can be broken down into state county. This rate includes any state county city and local sales taxes.

These vary by district. The average sales tax rate in California is 8551. You can read a breakdown of Californias statewide tax rate here.

The Orange County Sales Tax is collected by the merchant on all qualifying sales made. California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35. The new rate is 511 cents per gallon an increase of 6 cents per gallon from 511 cents per gallon.

COUNTY OF ORANGE TAX RATE BOOK. The minimum combined 2022 sales tax rate for Orange County Florida is 65. County of Orange Property Tax Rates 2020-2021 Auditor-Controller Frank Davies CPA.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. The Orange County Florida sales tax is 650 consisting of 600 Florida state sales tax and 050 Orange County local sales taxesThe local sales tax consists of a 050 county sales tax. The next California gas tax increase will take effect on July 1 2022.

There are a total of 474 local tax jurisdictions across the state collecting an average local tax of 2617. The Orange County California sales tax is 775 consisting of 600 California state sales tax and 175 Orange County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc. Orange County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Orange County totaling 025.

Automating sales tax compliance can. US Sales Tax Rates. The latest sales tax rate for Orange CA.

You can find more tax rates and allowances for Orange County and California in the 2022 California Tax Tables. The statewide California sales tax rate is 725. 2020 rates included for use while preparing your income tax deduction.

Local tax rates in California range from 015 to 3 making the sales tax range in California 725 to 1025. The California state sales tax rate is currently. Internet Property Tax Auction.

The base sales tax for gasoline at 225 is much lower than for most stuff. Method to calculate Orange County sales tax in 2021. The Sonoma County sales tax rate is.

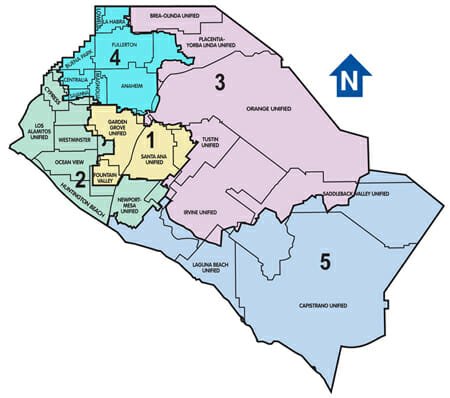

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. COUNTY OF ORANGE TAX RATE BOOK 2020-2021 INDEX TO TAX RATE BY CITIESDISTRICT ALPHABETIC LIST OF CITIES AND DISTRICTS CONTAINED IN TAX RATE AREA LISTINGS OF THIS BOOK. California local sales tax rates.

1788 rows California City County Sales Use Tax Rates effective April 1. Fast Easy Tax Solutions. The base state sales tax rate in California is 6.

Lowest sales tax NA Highest sales tax 1075 California Sales Tax. Thursday July 01 2021. Orange County Sales Tax Rates for 2022.

The latest sales tax rate for Orange County CA. The mandatory local rate is 125 which makes the total minimum combined sales tax rate 725. The 2018 United States Supreme Court decision in South Dakota v.

ORANGE COUNTY 775 City of Fountain Valley 875 City of Garden Grove 875 City of La Habra 825 City of La Palma 875. Groceries are exempt from the Orange County and Florida state sales taxes. Orange County collects an additional 050 which brings the Orange County sales tax 50 higher than the state minimum sales tax of 725.

Average Sales Tax With Local. Thursday July 01 2021. For clarity on when it is applied Honk reached out to the California Department of Tax and Fee Administration.

County of Orange. California sales tax rate. SALES AND USE TAX RATES CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION California Sales and Use Tax Rates by County and City Operative April 1 2022 includes state county local and district taxes.

The Orange County Sales Tax is collected by the merchant on all qualifying sales made within Orange County. 6 rows The Orange County California sales tax is 775 consisting of 600 California state. Find the most up-to-date California sales tax rates here.

The state of California keeps 600 of the sales tax collected and the additional 125 goes to the county 1 and city 25 funds. This rate is made up of 600 state sales tax rate and an additional 125 local rate. To review the rules in California visit our state-by-state guide.

A California gas tax increase took effect on July 1 2021 as part of annual inflation adjustment. This rate includes any state county city and local sales taxes. 2020 rates included for use while preparing your income tax deduction.

Has impacted many state nexus laws and sales tax collection requirements. Currency only paid in person at the Office of the Treasurer-Tax Collector in the County Service Center located at 601 N.

Oc Goodwill Donation Centers And Services

Orange County Property Tax Oc Tax Collector Tax Specialists

California Sales Tax Rates By City County 2022

Orange California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Restaurants That Accept Ebt In Orange County Ca California Food Stamps Help

Orange County Real Estate Market Report And Trends

Who Pays The Transfer Tax In Orange County California

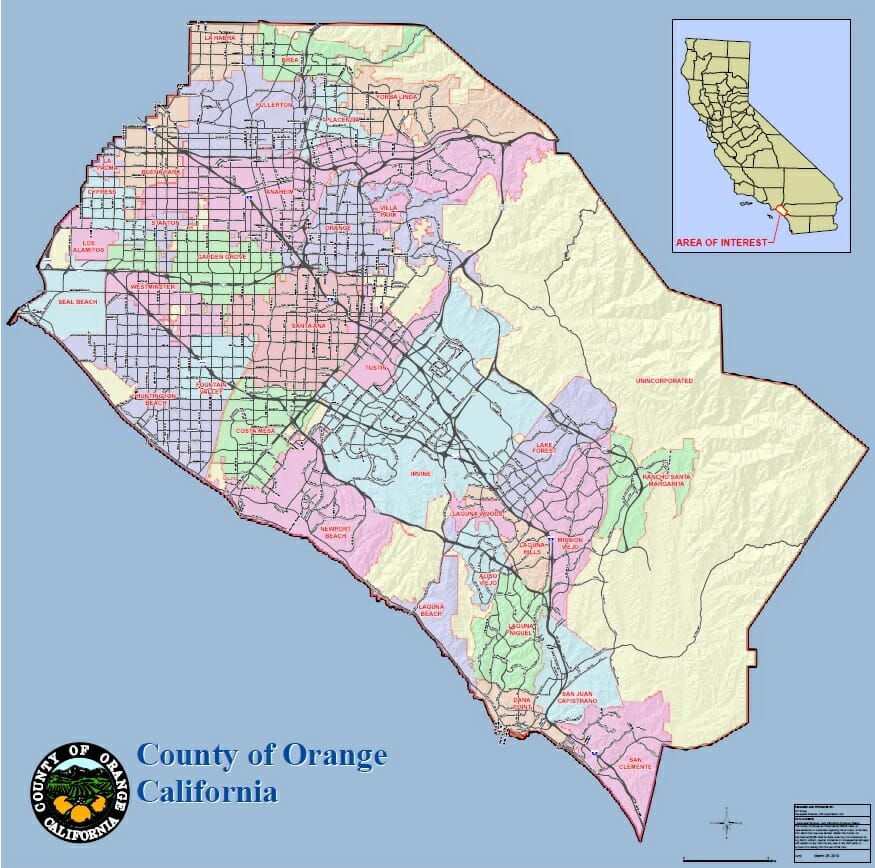

Orange County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Orange County Real Estate Market Report And Trends

84 000 A Year Now Qualifies As Low Income In High Cost Orange County Orange County Register

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Arts In California Could See A Renaissance Thanks To Huge Influx Of State Funding

Who Pays The Transfer Tax In Orange County California

Orange County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More